The ManicaPost

Kudzanai Gerede Business Correspondent

As the 2017 draws to an end, Post Business looks at some major economic highlights that characterised the business outlook throughout the course of the year. The economy traversed a challenging terrain with enormous headwinds chief among them being the acute cash shortages, high premiums for cash on Real Time Gross Settlement and mobile money transactions, and a price rebound out of deflation since 2014, all this taking a toll on business operations in the country.

On a positive note, the country recorded substantial gains in agriculture, a key sector that consequentially feeds into various other sectors such as manufacturing and pharmaceuticals through value chains. However, the manufacturing sector performance took a downturn, partly because of a generally low business activity in the country but largely as a result of foreign currency shortages for either importation of inputs or acquisition of new equipment and technologies.

The Confederation of Zimbabwe Industries (CZI) Manufacturing Sector Survey 2017 showed that 30 percent of firms in the sector are on the brink of collapse owing to foreign currency shortages. This is despite Central Bank prioritisation of foreign currency availability for productive players to settle foreign payments, but the waiting list has since overwhelmed the available foreign currency.

In his Mid-Term Monetary Policy statement in August, Reserve Bank of Zimbabwe chief Dr John Mangudya stated that the Central Bank had managed to secure an additional bond notes export incentive scheme of US$300 million under a standby liquidity support from Afrexim- bank which started rolling on the first of September with hopes to not only liquefy the economy but recapitalise depressed export production.

However, analysts were quick to advise the Central Bank on the need to clamp down on indiscipline within the financial services sector that saw fresh bond notes flooding the parallel market while local banks were running out of notes. The consequences of this led to high premiums on the parallel market which sparked inflation. Revenue figures, however, looked good for Treasury in 2017. Last year ZIMRA missed its US$3,60 billion target managing to collect a total of US$3,46 billion but exceeded its first quarter (FQ 1) gross collection target by 6 percent totalling US$ 862,47 million. This continued into FQ3.

As part of increasing revenue collection, ZIMRA has been encouraging SMEs to register and pay their presumptive taxes through outreach programmes across the country while it also embarked on the fiscalisation programme, which ensures configuration of fiscal devices to enable them to record sales and other tax information on the fiscal memory at the time of sale for use by the tax authorities in Value Added Tax administration.

To further bef up the export sector, Government in October removed export permits for all industrial commodities under a new Statutory Instrument 122 of 2017, as it sought to attract local manufacturers of commodities into the export sector by easing the export processes. Under the new arrangement, manufacturers will not need to seek Government authorisation for exporting their commodities as it is expected to improve efficiency to business.

The mining sector underwent notable improvements in 2017 particularly in chrome, diamond, coal and gold sector. Government nationalised chrome claims to small-scale indigenous players while it secured capital injection towards equipment, exploration and restructuring of gold, coal, diamond and chrome sub-sectors. US$80 million was injected into Zimbabwe Consolidated Diamond Company (ZCDC) for up scaling mining operations following the shutting down of joint venture companies in Chiadzwa.

ZCDC 2017 half year performance was at 1,1 million carats against 690 000 carats realised the previous year. Buoyed by recoveries of commodity prices on the international market, Government also recapitalised Hwange Colliery Company and since the capital injection, the company moved from a monthly production output of 30 000 tonnes last year to 300 000 tonnes a month.

Good times lie ahead following the US$400 million recapitalisation of the country’s sole railway liner NRZ after a successful joint bid by Diaspora Infrastructure Development Group, a consortium of Zimbabwean investors living abroad and South African investor, Transnet, ealier this year. The recapitalisation initiative will focus on acquisition and upgrade of wagons, upgrading the company’s information technology and signalling systems as well as increasing the parastatal’s capacity utilisation. Once the parastatal starts operating profitably, it increases its capacity to settle its US$144 million legacy debt.

Analysts hailed this development as a key driver to the reindustrialisation agenda as an efficient railway system is cost effective for transportation of goods. And still on infrastructure development, in August this year, Finance and Economic Planning Minister Patrick Chinamasa while addressing local and international delegates at a Local Authorities Investment Conference in Harare said Government would soon consider assenting to local authorities issuance of bonds to finance various infrastructure projects.

“Government will assist those local authorities whose finances are in order. We cannot continue to put money into a bottomless pit. We can only put money where finances are well managed. For those local authorities that are well managed I can sign off on that while I am blindfolded and give authority for you to raise loans by way of infrastructure bonds but you would need to demonstrate how that bond will be retired,” said the finance minister.

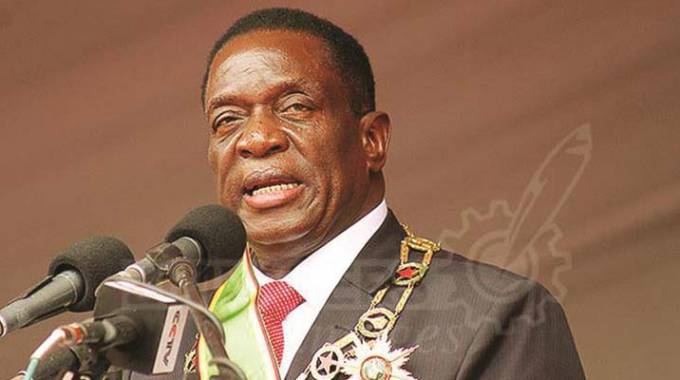

2017 will go down as a momentous year for the economy as it entered a new dispensation following the resignation of former President Cde Robert Mugabe and the ascendance of President Emmerson Mnangagwa seen as opening a new economic epoch for the country.

The new dispensation has already made adjustments to the Indigenisation and Empowerment Law by scrapping the 51-49 percent clause which has been a major deterrent to investment into the country. The 51-49 percent ratio will now only apply to the diamond and platinum sectors. Corporate governance issues are being tackled with the objective of curtailing rampant corruption which was derailing economic progress. This includes the externalisation of funds and assets three-month moratorium effected by the new President.